Upcoming Projects in the Middle East: What to Watch in 202

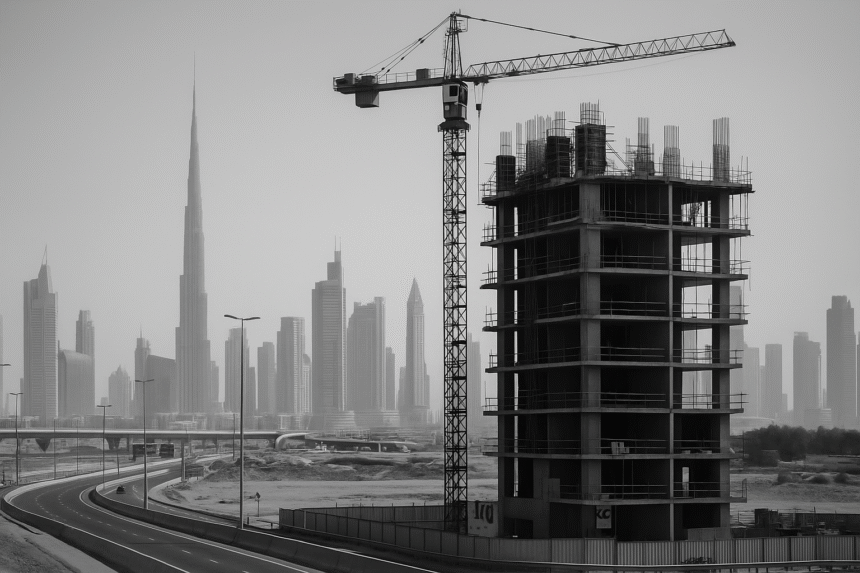

The upcoming projects in the Middle East are poised to reshape the region’s infrastructure and energy landscape. From smart cities to EV integration, governments across the Gulf are setting new benchmarks in scale, ambition, and sustainability.

For CEOs, infrastructure developers, EV suppliers, and B2B service providers, keeping an eye on tender activity and regional priorities is not just useful—it’s critical to strategic growth.

Why the Middle East Remains a Hotspot for Infrastructure

Gulf countries continue to invest in transformative infrastructure aligned with their national development visions, including Saudi Vision 2030, UAE Centennial 2071, and Oman Vision 2040. These initiatives drive demand for everything from clean energy systems to digital logistics networks.

The result? A forecasted $2 trillion pipeline of infrastructure, energy, transport, and mobility projects scheduled through 2030—with many headline tenders now launching in 2025.

High-Value Infrastructure Launches to Track

Some of the most impactful upcoming projects in the Middle East include:

-

NEOM (Saudi Arabia): A $500 billion megacity powered by renewable energy and advanced tech, featuring The Line, Oxagon, and Trojena.

-

Etihad Rail Expansion (UAE & Oman): Boosts regional logistics and supports green freight.

-

King Salman Park (Riyadh): The world’s largest urban park, emphasizing green mobility and sustainable design.

-

Masdar’s Green Energy Projects (UAE): Solar parks and EV charging integration in residential zones.

-

Red Sea Global: Massive hospitality and tourism investment, all-electric transportation ecosystem included.

Each of these projects opens doors for contractors in EV charging, mobility tech, grid upgrades, smart lighting, waste systems, and civil infrastructure.

Tender Trends: What’s Changing in 2025

Infrastructure tendering across the Middle East is becoming more structured, transparent, and ESG-driven. Here are some key changes:

-

Integrated mobility and energy scopes: Tenders often bundle EV charger installation, grid upgrades, and software platforms together.

-

ESG scoring is now weighted in bid evaluations, especially in UAE and Saudi Arabia.

-

Prequalification (PQ) timelines are shorter, and often digital.

-

Local content requirements (ICV/Saudization) are strictly enforced.

Top public tender platforms include:

-

Etimad.sa (Saudi Arabia)

-

MOF Tenders Portal (UAE)

-

ADCCI / Abu Dhabi Projects for sector-specific listings

-

Oman Tenders Board for cross-sector opportunities

UAE vs. Saudi Arabia: Different Styles, Same Momentum

Both countries are leading in terms of volume and value of upcoming projects in the Middle East, but they differ in approach.

Saudi Arabia

-

Heavy focus on giga-projects led by the Public Investment Fund (PIF)

-

Complex consortium-based tenders

-

Emphasis on construction, tourism, and hydrogen

-

National incentives for long-term partnerships with PIF-linked companies

UAE

-

Fast-paced, modular tendering

-

Focused on EV charging infrastructure, ports, and logistics

-

Quick adoption of digital procurement tools

-

Strong DEWA-driven green infrastructure roadmap

Both countries provide huge opportunities—but the strategy to access them must be tailored to local procedures and investment priorities.

EV Sector Opportunities Embedded in Infrastructure

EV infrastructure is no longer a side note. In 2025, it’s a core deliverable in most mixed-use or transport-related tenders.

Watch for:

-

Standalone EV charger supply & install tenders in new districts

-

EV-first design in smart city packages (e.g., in NEOM, Lusail, and Masdar)

-

Public transit upgrades that include fleet electrification and depot charging

-

Government-owned property retrofits requiring commercial EV solutions

Major players like Siemens, ABB, and local operators such as CATEC are all active in these projects, but there’s space for niche specialists—especially those offering local assembly or service contracts.

Key Sectors Driving Opportunity

As you evaluate where to focus, consider these high-growth sectors:

-

Urban Mobility: EV chargers, micromobility stations, traffic control software

-

Sustainable Logistics: Depot electrification, last-mile hubs, cold-chain EV trucks

-

Tourism & Real Estate: Luxury developments with green transport features

-

Industrial Parks: On-site power, EV readiness, grid-friendly load balancing

-

Data & Connectivity: Fiber infrastructure, IoT platforms, smart sensors

Conclusion: Make 2025 the Year of Market Entry

The upcoming projects in the Middle East are not just bigger—they are smarter and greener. For infrastructure providers, EV firms, and tech integrators, now is the time to secure your place in long-term public and private sector projects.

Here’s what to do next:

-

Register with regional tender platforms

-

Build local partnerships to meet localization requirements

-

Align your service or product roadmap with ESG and clean tech priorities

-

Monitor UAE and Saudi announcements weekly for early signals

The Middle East is no longer just a construction market—it’s a sustainable innovation hub in motion.

Leave a Reply