What Is an Offtake Agreement in Mining? (FAQ)

Offtake agreements in mining can seem technical or intimidating, especially if you’re new to the industry. Yet understanding them is essential for any investor, consultant, or mining executive. This FAQ breaks down everything you need to know—clearly and simply.

Who Is This FAQ For?

This guide is designed for:

- Startup founders and executives in the mining or energy sector

- Business consultants supporting mining companies

- Legal professionals navigating mineral export contracts

- Investors looking to assess the viability of mining projects

If you’re dealing with early-stage mine development, fundraising, or commodity export deals, this FAQ will help you understand how offtake agreements protect your interests.

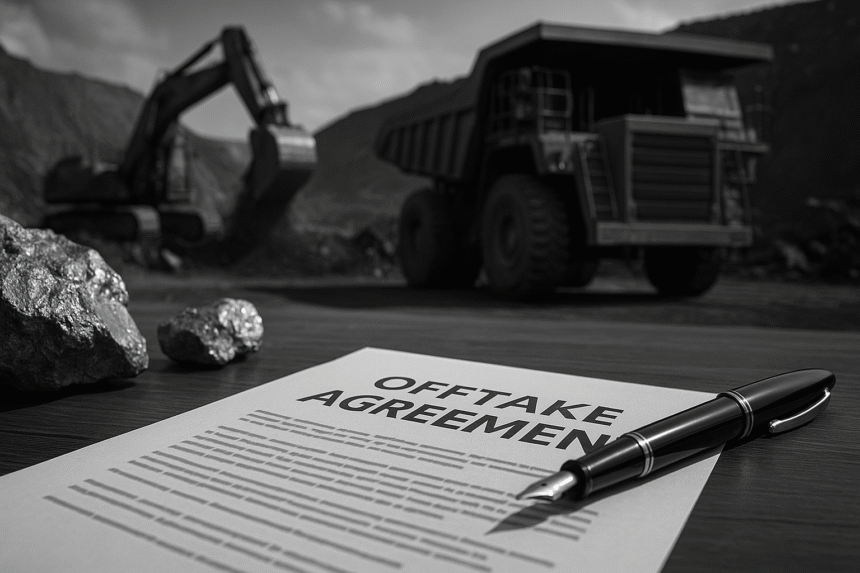

Q1: What is an offtake agreement in mining?

An offtake agreement is a legally binding contract between a mining company (the seller) and a buyer, where the buyer agrees to purchase a portion—or all—of the mine’s future production.

It usually covers:

- Quantity and type of material (e.g., copper ore, lithium, iron)

- Pricing formula

- Delivery terms and schedule

- Duration of the agreement

Offtake agreements often serve as a key financial tool, helping mining companies secure project financing by guaranteeing future revenue streams.

Q2: Why are offtake agreements important for mining startups?

Because mining projects require heavy upfront investment and long timelines before revenue begins, offtake agreements give confidence to lenders and investors.

Here’s why they matter:

- Revenue assurance: They demonstrate predictable income post-production

- Financing support: Banks and project financiers often require offtake commitments

- Market access: They lock in buyers before the product is even mined

In short, they reduce risk and improve the chances of funding success.

Q3: Who are the typical buyers in an offtake agreement?

Buyers include:

- Commodity traders (e.g., Glencore, Trafigura)

- Manufacturers or refiners (e.g., battery manufacturers for lithium)

- State-owned enterprises in countries needing strategic minerals

These buyers secure supply in advance, especially in high-demand sectors like renewable energy, automotive, and construction.

Q4: What’s included in an offtake agreement?

Most agreements cover:

- Product specifications (e.g., purity levels, grade)

- Quantities to be purchased

- Pricing mechanism (e.g., fixed price, index-linked, or spot pricing)

- Delivery terms (Incoterms, transport method)

- Force majeure and dispute resolution clauses

- Duration and renewal terms

It may also include conditions precedent such as reaching commercial production.

Q5: Is an offtake agreement the same as a sales contract?

Not exactly.

A sales contract is typically short-term and for products already produced. An offtake agreement, on the other hand:

- Is signed before production begins

- Is often long-term (3–15 years)

- Plays a role in project financing

Think of it as a pre-arranged sales commitment.

Q6: Can offtake agreements be terminated?

Yes, but it depends on the agreement.

Termination may occur if:

- The mining company fails to reach production

- Force majeure (unforeseen events) prevents fulfillment

- Both parties agree to early termination

However, cancellation often triggers compensation or legal consequences. That’s why clarity in the termination clause is essential.

Q7: What legal risks should be considered?

Key legal considerations include:

- Exclusivity clauses: Do they prevent you from selling to others?

- Take-or-pay obligations: Is the buyer required to pay even if they don’t take delivery?

- Governing law and jurisdiction: Important for dispute resolution

- Change of control provisions: What happens if either party is acquired?

Tip: Always get the agreement reviewed by a lawyer with mining or commodity experience.

Q8: How do offtake agreements support ESG goals?

Some offtake deals now include:

- Sustainability certifications

- Emission targets or environmental monitoring

- Social impact reporting requirements

This is especially true in metals critical to green energy (e.g., cobalt, nickel, lithium), where downstream buyers are under pressure to prove clean supply chains.

Q9: Are offtake agreements enforceable internationally?

Yes, if drafted properly.

To ensure enforceability:

- Use internationally recognized terms (e.g., Incoterms)

- Choose a governing law and neutral arbitration forum (e.g., LCIA, ICC)

- Include clear definitions, timelines, and remedies

This reduces disputes and improves investor confidence.

Q10: Can small mining firms use offtake agreements?

Absolutely.

In fact, junior mining companies often rely on offtake deals to:

- Secure initial funding

- Build credibility

- Attract larger partners

Even partial offtake deals (covering only a percentage of output) can be effective.

Bonus Tip: Don’t sign too early

Many miners rush to sign offtake agreements to impress investors. But signing before you fully understand your costs, capacity, or permitting status can backfire.

Tip: Time it strategically—when you can negotiate from a position of strength.

Final Thoughts + Call-to-Action

Offtake agreements are more than just contracts—they’re growth enablers for mining companies.

Handled wisely, they open the door to financing, stability, and market access. Mismanaged, they can limit your freedom or expose you to costly legal issues.

Want to review or negotiate an offtake agreement? Book a consultation with our legal team specializing in mining contracts and international trade.

Leave a Reply