The Future of EV in the Middle East: Trends and Barriers Business Leaders Must Watch

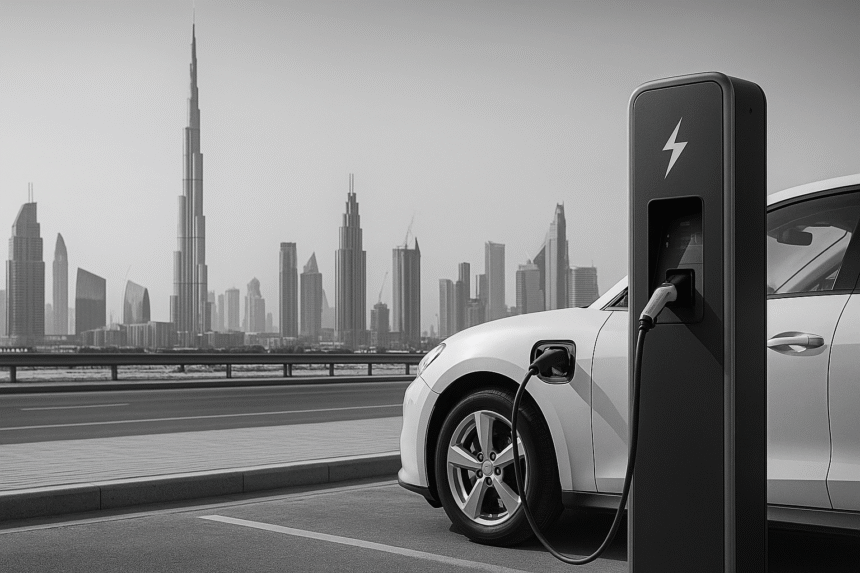

As demand for sustainability grows globally, the future of EV in the Middle East is gaining traction. From large-scale government incentives to increasing public awareness, the region is seeing a shift in how mobility is powered. Yet, despite promising headlines, the real road to EV dominance is shaped by both momentum and roadblocks.

For CEOs, infrastructure developers, and government suppliers, understanding the EV landscape across the region is essential—not just to ride the wave, but to help shape it.

The EV Landscape in the Middle East: An Overview

The Middle East’s commitment to clean transportation is part of a broader push toward climate-resilient infrastructure. While countries like the UAE and Saudi Arabia are leading, the entire GCC bloc is showing increasing interest in electric vehicles, albeit at varying speeds.

Current EV Adoption Rates (2024–2025):

-

UAE: Around 15,000 EVs on the road, with Dubai targeting 42,000 by 2030.

-

Saudi Arabia: Fast-growing, with Lucid’s local factory signaling future domestic manufacturing.

-

Qatar: Government-led EV buses and fleet electrification underway.

-

Oman & Bahrain: Early-stage, with smaller but steady adoption.

-

Kuwait: Planning regulations to mandate EV charging stations in new developments.

While these numbers are still small relative to global markets, the growth trajectory is steep, especially in the UAE and KSA.

Infrastructure Readiness: Building the Network

One of the biggest enablers of EV growth is infrastructure. Without a robust and convenient network of chargers, adoption stalls.

Key factors affecting EV in the Middle East infrastructure:

-

Charger Density: The UAE leads with over 900 public charging stations, while others are just beginning deployment.

-

Fast Charging: High-speed DC charging is still limited, especially in remote areas and border crossings.

-

Grid Integration: Utility authorities like DEWA (Dubai) and ADDC (Abu Dhabi) are adapting their systems to support EV load balancing.

-

Private Sector Role: Companies like CATEC, ABB, and Siemens are providing installation, software, and maintenance solutions across commercial and government sites.

Policy and Regulatory Gaps

While progress is evident, several policy-level gaps still limit acceleration.

-

Inconsistent Standards: Charging connector types and power output standards vary between countries, delaying regional integration.

-

Taxation and Incentives: While Dubai offers free parking and reduced tolls for EVs, many countries still lack consistent incentives.

-

Import Regulations: High customs duties and unclear classification policies complicate EV imports in some Gulf markets.

-

Procurement Challenges: Public sector tenders often lack specific EV-friendly scoring criteria, discouraging innovation.

To unlock the future of EV in the Middle East, harmonized policy frameworks will be crucial.

Cultural Factors and Consumer Sentiment

Infrastructure and incentives aside, one key barrier remains: consumer trust.

Challenges in changing perception:

-

Range Anxiety: A concern in less urban areas with fewer chargers.

-

Heat Resistance: EVs face skepticism in high-temperature conditions—though newer models are adapting well.

-

Resale Value Concerns: A limited secondary market makes buyers hesitant.

-

Brand Loyalty: The popularity of fuel-powered SUVs and luxury vehicles remains strong.

However, the narrative is changing. Youth populations, sustainability campaigns, and visible government fleets are helping normalize EV use.

Opportunities for Stakeholders

For CEOs and executives looking to expand in the region, here are the key growth opportunities in the EV ecosystem:

-

Public-Private Partnerships (PPPs): Governments are increasingly open to joint ventures for EV infrastructure rollout.

-

Fleet Electrification: Delivery companies, school buses, and corporate fleets are ripe for conversion.

-

Energy-Transport Synergies: Solar-powered charging hubs and microgrid solutions offer innovation room.

-

Data-Driven Platforms: Charging analytics, dynamic pricing, and user apps can differentiate offerings.

-

Local Assembly or Warehousing: Establishing supply hubs in the UAE or KSA to reduce logistics friction.

Looking Ahead: What’s Next?

The next five years will define the role of EV in the Middle East—either as a fringe solution or as a mainstream reality. The direction is clear: regional governments are serious about clean mobility. The challenge is execution at scale.

For companies that can solve infrastructure gaps, integrate clean energy, and align with local regulatory frameworks, the reward is long-term market leadership.

Conclusion: Strategy Beats Hype

If you’re in the EV, energy, or infrastructure business, now is the time to:

-

Localize your product roadmap for Middle Eastern climate and regulation,

-

Build relationships with municipalities and regulators,

-

Create pricing and service models that reduce perceived risk for end users.

The shift to electric vehicles is no longer a question of if—but of how fast. The companies that succeed will be those who treat the Middle East not as an extension of global strategy, but as a high-growth region with its own challenges, timing, and culture.

Leave a Reply