Navigating the Crossroads: How M&A in the Middle East and Americas Is Shaping Global Business Strategy

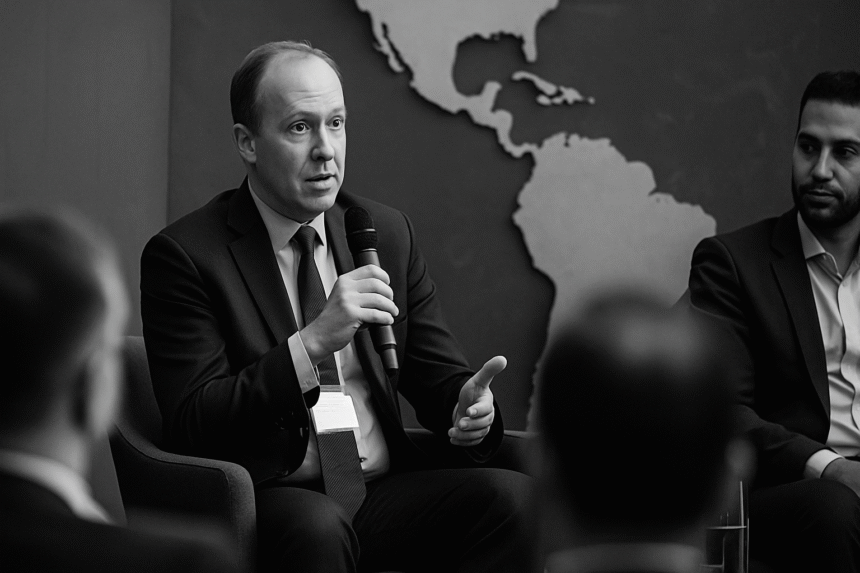

Jonathan P. Noble of AMERELLER to spotlight strategic insights on deal-making across borders at the 2025 Leaders League Alliance Summit in Miami.

Introduction:

“Mergers and acquisitions aren’t just numbers on a spreadsheet. They are chess moves in an increasingly interconnected world.” That line, shared by AMERELLER in their LinkedIn announcement of Jonathan P. Noble’s upcoming panel at the 2025 Leaders League Alliance Summit in Miami, struck a chord with legal, business, and financial communities watching global shifts unfold.

Background & Context:

Jonathan P. Noble is a seasoned partner at AMERELLER, a law firm with deep roots in Middle East legal frameworks and international transactions. In June 2025, he will take the stage at a premier industry event—the Leaders League Alliance Summit: Law & Innovation 2025—to unpack the nuances of the panel topic: “2025 M&A Landscape: Americas and the Middle East.”

The summit takes place in Miami, a strategic geographic bridge and business hub between North and South America. As AMERELLER explains, understanding M&A in these regions requires grappling with political volatility, evolving regulatory standards, and an increasingly sophisticated investor class.

Main Takeaways / Observations:

1. The Rise of Cross-Border Complexity With businesses seeking growth across borders, transactions are no longer domestic by default. M&A in the Middle East increasingly involves counterparties, financing, and legal obligations that span continents.

Jonathan Noble brings an important insight to the table: Cross-border deals demand legal advisors who can navigate local compliance and synthesize it with international standards. From tax treaties to FDI restrictions and dispute resolution forums, due diligence in 2025 means mapping not just company assets but geopolitical terrain.

2. The Regulatory Renaissance The AMERELLER post also underscores a key challenge for M&A lawyers in 2025: regulatory evolution. Governments in both regions are tightening foreign investment oversight, launching digital registries, and redefining antitrust laws in response to tech consolidation and sovereign fund power.

The Leaders League panel will explore how these shifts are impacting deal structures. For example, Middle East jurisdictions like the UAE and Saudi Arabia are refining local content rules and economic substance requirements, directly influencing acquisition feasibility.

3. ESG and M&A: A New Strategic Filter Environmental, Social, and Governance (ESG) criteria now shape investment decisions and, consequently, M&A due diligence. From carbon disclosures to human rights litigation risk, buyers must look beyond financials.

Jonathan Noble’s background with regional compliance gives him an edge in exploring how ESG mandates in the Americas contrast with emerging sustainability frameworks in the GCC and broader MENA region.

4. Strategic Deal-Making in Uncertain Markets AMERELLER’s LinkedIn post doesn’t just highlight challenges—it emphasizes strategy. With currency fluctuations, inflation, and a volatile commodities market, dealmakers need not just courage but clarity.

Jonathan will speak on aligning M&A strategy with market conditions: structuring earn-outs to account for volatility, using dual-tranche financing, and drafting indemnity clauses that reflect post-pandemic risk appetites.

Community Reaction:

While direct comments on the AMERELLER post were few, LinkedIn engagement suggests an active legal audience is following developments in M&A trends, especially those with cross-border elements. Professionals tagged the post to peers in the MENA region and commented favorably on Jonathan’s upcoming participation.

Our Perspective / Analysis: As legal advisors, we see this moment as critical.

Contracts involving M&A in 2025 must go beyond boilerplate. Key clauses such as:

- Warranties and representations need tailored language to address AI-driven business models and regulatory unknowns.

- Governing law and jurisdiction clauses must reflect the rise in investor-state arbitrations.

- Tax indemnity provisions must anticipate local reforms on digital tax and economic substance.

Jonathan Noble’s presence on this panel signals AMERELLER’s continued leadership in cross-border transactional law. It’s also a recognition of the value firms must offer: not just deal facilitation, but risk foresight.

Call to Reflection or Action (Closing):

If you’re a business leader, ask yourself this: Is your legal strategy proactive or reactive when it comes to global deals? More importantly, do your M&A advisors understand not just the law in your region, but the pulse of markets and politics abroad?

As AMERELLER’s announcement shows, the 2025 M&A landscape is about more than closing deals—it’s about creating resilient, compliant, and strategically sound partnerships across continents.

Click Here to visit LinkedIn Post

Leave a Reply