Introduction

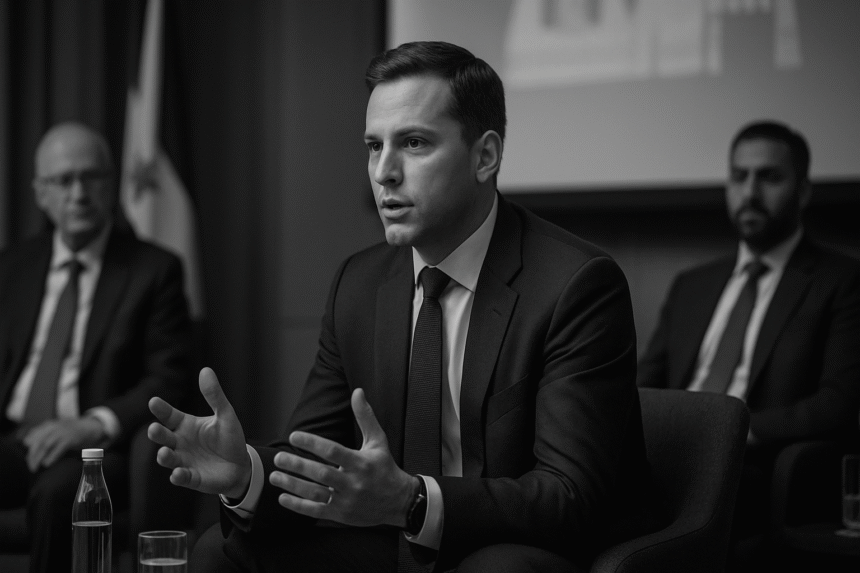

Jonathan P. Koshko on Why Context Now Defines Market Entry

“Market entry is no longer just about capital and compliance—it’s about context.” With that striking insight, Jonathan P. Koshko, Partner at AMERELLER, took to LinkedIn ahead of the Leaders League Alliance Summit, offering a fresh lens on how cross-border M&A between the Americas and MENA is evolving. His post didn’t just preview a panel—it offered a masterclass in reading the room before you enter it.

Background & Context:

Jonathan P. Koshko is a seasoned advisor on cross-border transactions and regulatory risk, currently serving as a Partner at international law firm AMERELLER. His legal work spans investment advisory, corporate restructuring, and regulatory frameworks across the Middle East. With deep insight into the legal and political dynamics of the region, Koshko’s voice stands out—especially as global M&A activity recalibrates post-COVID, amid shifting geopolitical landscapes.

Koshko’s participation at the 2025 Leaders League Alliance Summit – Americas & the Middle East came at a time when businesses are urgently rethinking deal flow strategies, foreign investment scrutiny, and operational agility. In his LinkedIn post, he teased a panel titled “2025 M&A Landscape: Americas & the Middle East,” where he explored how legal frameworks and political nuance are now as critical as financial modeling in deal structuring.

Key Takeaways from the Post:

1. Geopolitics Are Now Deal Variables

Koshko warns that cross-border M&A is no longer governed solely by economics. From sanctions regimes to regulatory reform, dealmakers must now factor in foreign policy shifts and investor perception.

“Political winds matter—whether in due diligence or boardroom decisions.”

2. Regulatory Lag Is the Hidden Risk

As jurisdictions play catch-up with innovation and foreign investment trends, delays in legal reform can derail even the most promising deals. Koshko calls for deal strategies that build in flexibility for regulatory uncertainty.

3. Understanding Soft Power Is a Deal Advantage

Legal advisors must now interpret more than statutes—they must read sentiment. Cultural fluency and contextual awareness are key to helping clients enter markets like the UAE or Saudi Arabia with confidence.

“We can’t export contracts and expect compliance. We need alignment, not just enforcement.”

Community Reaction:

The post resonated with deal lawyers, advisors, and private equity professionals, drawing comments like “Appreciate the focus on contextual awareness” and “M&A is definitely not spreadsheet-driven anymore.”

Attendees at the Summit echoed Koshko’s sentiment, noting that the most successful cross-regional deals are backed by not just due diligence—but deep listening.

Our Perspective:

As legal consultants advising on market entry, investment structuring, and cross-border partnerships, we see firsthand how legal documents must adapt to global nuance. Koshko’s post is a reminder: behind every merger or acquisition is a matrix of trust, timing, and translation—legal, cultural, and political.

It also reinforces a key lesson for law firms: legal frameworks must now be packaged with strategic empathy. In our own practice, we’ve begun embedding “context notes” into contract reviews—explaining how local dynamics could shift enforceability, sentiment, or risk.

Call to Reflection:

If you’re advising on international deals, ask yourself: Are you giving your clients just the law—or the lay of the land? Because in today’s world, closing a deal is about much more than just getting signatures. It’s about alignment across borders, languages, and expectations.

Leave a Reply