Game-Changing Insights into Saudi Arabia Investment Action Transforming Global Markets

Introduction

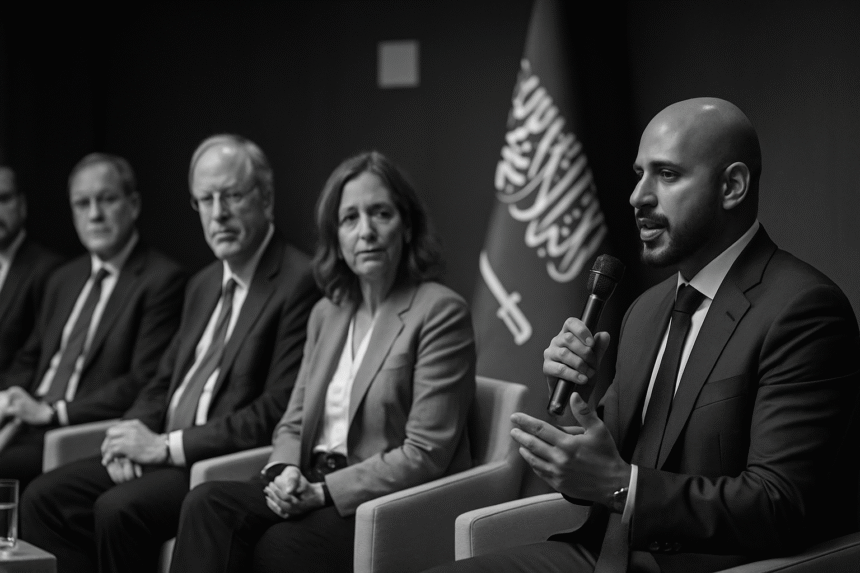

Saudi Arabia investment action is transforming the way global businesses and investors view the Kingdom. No longer just a future opportunity, it’s now a present force driving unprecedented partnerships and economic growth. Mohammed H. Al Qahtani, CEO of Saudi Arabia Holding Co., made this clear at the World Economic Forum, delivering a bold statement that shattered old stereotypes and sparked meaningful global dialogue.

Background & Context:

Mohammed H. Al Qahtani, as a seasoned executive at the forefront of private sector transformation, has long been a vocal champion of Saudi Arabia investment action aligned with Vision 2030.

In his widely shared LinkedIn post, summarizing a WEF panel featuring BlackRock and other global institutions, Al Qahtani reinforced a key theme: Saudi Arabia isn’t waiting—it’s moving.

This message landed at a time when the Kingdom had just announced a $300 billion investment commitment to U.S. partnerships, further validating its shift from a perceived outlier to a serious player in Gulf investment opportunities and Middle East market entry.

Main Takeaways / Observations:

1. Perception vs. Performance

There remains a significant gap between how Saudi Arabia is viewed by traditional Western investors and how it is operating on the ground. Al Qahtani’s message challenged outdated narratives and highlighted the bold moves being made through Saudi Arabia investment action.

These include deregulation, streamlined licensing, and full foreign ownership options—making it a magnet for companies looking to penetrate Middle East markets with agility.

2. Leadership That Executes

The panel discussion didn’t just highlight optimism—it reflected execution. BlackRock and other institutional powerhouses expressed clear interest, citing Saudi Arabia’s regulatory maturity, youth-led leadership, and capital readiness.

For B2B firms weighing Middle East market entry, this is a signal to prepare. Align your legal, operational, and digital infrastructure to comply with regional standards and capitalize on early-mover benefits.

3. Vision 2030 Is Now

Al Qahtani made it clear: Vision 2030 is not an ambition—it’s a playbook in motion.

From giga-projects like NEOM to legal reforms in investment law and arbitration, Saudi Arabia investment action is happening daily.

This momentum creates a fertile ground for strategic partnerships, making it a goldmine for those exploring Gulf investment opportunities.

Read about powerful Startup Accelerators in Saudi Arabia Fueling B2B Innovation

Community Reaction:

Al Qahtani’s post received 660+ reactions and over 60 comments. But it wasn’t just praise—it was validation.

-

Natalie Williams, an expat from the U.S., said: “It’s been a wonderful experience, happy to share it.”

-

Mohamed Alsahi wrote: “Saudi Arabia has a great investment climate… promising economic opportunities.”

-

William Drown predicted: “The fields and bountiful harvests of the Arabian Peninsula will fill the hunger pains of God’s people.”

Clearly, this isn’t hype. It’s recognition of the real-world Saudi Arabia investment action that’s attracting attention from seasoned investors, entrepreneurs, and diplomats alike.

Our Perspective / Analysis:

From a legal and strategic advisory standpoint, the significance of Saudi Arabia investment action cannot be overstated. This shift is more than a trend; it marks a fundamental transformation in how the Kingdom positions itself on the global investment stage. Companies contemplating market entry or expansion into the Gulf region must recognize that Saudi Arabia investment action is backed by robust regulatory reforms, enhanced legal protections, and a growing ecosystem that encourages foreign capital inflows.

This proactive approach reduces traditional risks associated with emerging markets, offering a clearer pathway for business growth and sustainable returns. Moreover, Saudi Arabia investment action is driving the creation of new frameworks for collaboration, enabling international investors to form more effective and compliant partnerships with local entities. The momentum behind this action reflects the Kingdom’s commitment to becoming a top-tier global investment destination — a move that can’t be ignored by serious players.

Ignoring Saudi Arabia investment action risks missing out on one of the most significant opportunities of the decade, as the Kingdom unlocks its full economic potential through Vision 2030 initiatives.

Call to Reflection / Action:

If you still view Saudi Arabia as a distant or secondary market, it’s time to rethink your strategy. Saudi Arabia investment action is no longer a concept—it’s happening now, reshaping the region’s economic landscape and creating tangible opportunities for businesses worldwide.

Waiting on the sidelines means losing valuable ground to competitors who are already engaging with this dynamic market. The Kingdom’s decisive moves to implement Vision 2030, supported by Saudi Arabia investment action, are driving real changes in infrastructure, legal certainty, and investor support. These developments are transforming Saudi Arabia into a hub for innovation, commerce, and sustainable growth.

The key question for your organization is: will you join this wave of progress and position yourself at the forefront of one of the world’s fastest-evolving markets, or will you be left behind as others seize the opportunities unlocked by Saudi Arabia investment action?

Act now to align your business strategy with this powerful movement and secure your place in the Kingdom’s future.

click here to visit LinkedIn Post

Leave a Reply