Fundraising Reality Check: The One Sentence That Sparked a 100+ Comment Thread from Founders and VCs”

What started as a candid jab at startup fundraising tactics turned into one of LinkedIn’s most honest threads about pitching, investor psychology, and the brutal clarity needed in a noisy ecosystem.

Introduction (Lede Paragraph):

“Here’s my availability for calls this week: none.”

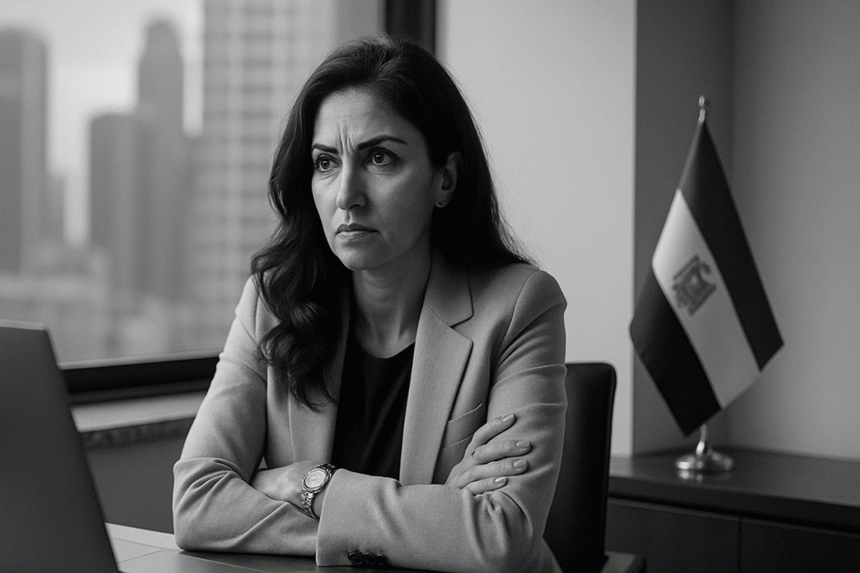

That’s how Rana El Kaliouby opened her latest LinkedIn post—sharp, witty, and unmistakably true to her style. What followed wasn’t just a punchline, but a full-on reality check about how founders and investors are navigating the ever-evolving (and sometimes chaotic) world of early-stage fundraising. The comment section? A masterclass in real talk from the startup frontlines.

Background & Context:

Rana El Kaliouby is an entrepreneur, AI thought leader, and investor whose perspective spans both sides of the startup table. In her post, she offers a humorous but cutting commentary on the performative busyness that has crept into founder-investor dynamics.

With investor inboxes overflowing and founders stuck in pitch loops, this post landed at the perfect moment. As deal-making cools in certain sectors and tightens in others, transparency and mutual respect are becoming more valuable than pitch decks and buzzwords.

Main Takeaways / Observations:

Investor Time is Not a Badge of Honor

One of Rana’s key messages: scheduling games and artificial scarcity don’t signal value—they signal noise. Investors want clarity, not calendar acrobatics.

Authenticity Cuts Through Noise

Founders who speak plainly, share traction, and get to the point stand out. Rana’s style of directness resonated precisely because it’s rare.

Everyone’s Tired of the Theatrics

From founders to fellow investors, the thread is full of professionals echoing the same frustration: real work beats posturing every time.

Community Reaction:

The post sparked over 200 reactions and 100+ comments, with founders, angel investors, operators, and ecosystem veterans weighing in. From hilarious takes on how startup deck filenames evolve (e.g., “final_FINAL_THISONE”) to hard-earned truths about investor expectations, the thread felt like a virtual founders’ roundtable.

Highlights include:

-

Jonathan Huhn: “This is the raw truth with so much wisdom in it.”

-

Emmanuel Onwuka: “Not artificial scarcity. Just real traction.”

-

Adewale Ogungbemile: “This hits hard. Real traction, clarity, and docs beat manufactured urgency.”

Our Perspective / Analysis:

From a legal and business advisory perspective, the takeaways are spot on. Many founders over-rotate on timing, structure, and signaling, while overlooking core investment fundamentals: clarity of vision, legal readiness, and operational traction.

We advise founders to spend less time orchestrating narrative spin and more time aligning internal readiness with external communication. Investors don’t need a show—they need a thesis they can trust.

Call to Reflection or Action (Closing):

Are you overcomplicating your investor strategy to sound more in demand—or are you focused on building something investors would actually fight to be part of?

Cut the clutter. Build the clarity. Skip the “Thursday slots only” line.

Click here to visit LinkedIn Post

Leave a Reply