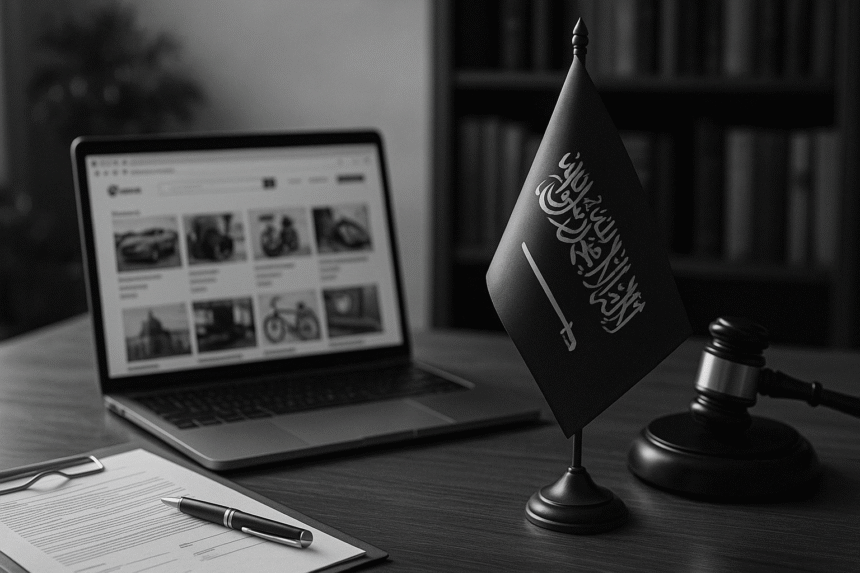

Can You Create a Haraj Website Abroad for Saudis?

Haraj-style websites—online marketplaces where users can post, buy, and sell goods or services—are incredibly popular in Saudi Arabia. With a growing number of Saudis living abroad or foreign entrepreneurs eyeing the Gulf market, the question often arises: Can you legally operate a Haraj website from abroad targeting Saudi users?

The answer is: Yes, but only if you understand and comply with the legal landscape. Saudi Arabia has specific regulations for eCommerce, consumer protection, data privacy, and taxation that can still apply even if the platform is hosted abroad.

In this article, we’ll explore the legal setup for cross-border platforms targeting Saudi users, including compliance risks and business structuring strategies.

Hosting Abroad vs. Targeting the Saudi Market

Just because your server is hosted in the U.S., Europe, or UAE doesn’t mean you can ignore Saudi law. What matters more is who your users are and where your services are accessed.

Saudi Law Applies If:

- Your website is accessible from Saudi Arabia

- You run paid ads targeting Saudi residents

- Your platform supports Arabic and prices in SAR

- You allow transactions from Saudi-based users or merchants

In short, if your business intends to engage Saudi consumers or sellers, you must comply with local regulations—even if you’re based abroad.

Key Legal Requirements from Saudi eCommerce Law

Saudi Arabia’s eCommerce Law (Royal Decree No. M/126 dated 07/11/1440H) outlines responsibilities for online service providers.

Core Obligations:

- Provide clear company/contact information on the platform

- Protect user data under Saudi Personal Data Protection Law (PDPL)

- Ensure fair practices such as disclosing terms and prices

- Offer customer support and complaint mechanisms

- Register your platform with the Ministry of Commerce, especially if your business exceeds a certain revenue threshold or targets citizens consistently

Failure to comply can result in platform bans, fines, and blocked domains.

Consumer Protection and Liability Rules

Running a Haraj platform doesn’t make you liable for every user’s actions—but it does come with responsibilities.

You May Be Held Liable If:

- You fail to moderate illegal or offensive listings after being notified

- You profit from user-generated sales without proper licensing

- Your terms and conditions do not comply with Saudi consumer law

- You collect and store user data without consent or proper protection

Best Practices:

- Draft a clear Terms of Service and Privacy Policy in Arabic and English

- Include a moderation policy and reporting mechanism

- Notify users that they are responsible for the legality of their listings

VAT and Tax Implications

Saudi Arabia imposes a 15% Value-Added Tax (VAT) on digital services provided to Saudi residents—even by foreign companies.

Your Obligations May Include:

- Registering with ZATCA (Saudi tax authority) if your revenue exceeds the threshold

- Charging VAT on sales or commissions from Saudi users

- Filing periodic tax returns

You may also be subject to withholding tax if you engage with Saudi business partners. Proper legal and accounting guidance is essential.

Intellectual Property and Jurisdiction

If you’re building a Haraj-like platform, you’re likely investing in branding, software, and user experience. Protect your IP.

IP Considerations:

- Trademark your brand in Saudi Arabia, even if you’re based abroad

- Register your domain name and secure it with Saudi-compliant DNS if required

- Include IP ownership clauses if working with third-party developers

Jurisdiction for Disputes

If you get into a dispute with a Saudi user or company, local courts may claim jurisdiction.

Best practices:

- Include a governing law clause in your ToS (e.g., UAE or English law)

- Use arbitration clauses to avoid Saudi courts where possible

- Offer bilingual contracts to avoid interpretation conflicts

Business Structuring: Do You Need a Local Presence?

You don’t always need to open a company in Saudi Arabia—but it can help.

Advantages of a Local Entity:

- Easier banking and payment processing

- Better trust with Saudi users and partners

- Tax compliance becomes more straightforward

Alternative: Partner with a Saudi-based distributor or agent and use a licensing model. In all cases, you’ll still need legal clarity.

Conclusion

Creating a Haraj-style website abroad for Saudi users is possible—but it requires strategic planning and legal foresight. If your platform targets Saudi residents in any serious way, Saudi law likely applies.

From eCommerce compliance and VAT registration to content liability and IP protection, there are many moving parts. Engage with a legal consultant who understands cross-border eCommerce and Saudi regulation before you launch.

With the right structure, you can serve the Saudi market effectively—even from afar.

Leave a Reply